Business Insurance in and around Bloomington

One of the top small business insurance companies in Bloomington, and beyond.

Helping insure small businesses since 1935

- Lexington

- Normal

- Hudson

- Towanda

- Chenoa

Your Search For Outstanding Small Business Insurance Ends Now.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a home improvement store, a fabric store, a home cleaning service, or other.

One of the top small business insurance companies in Bloomington, and beyond.

Helping insure small businesses since 1935

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, surety and fidelity bonds or commercial liability umbrella policies.

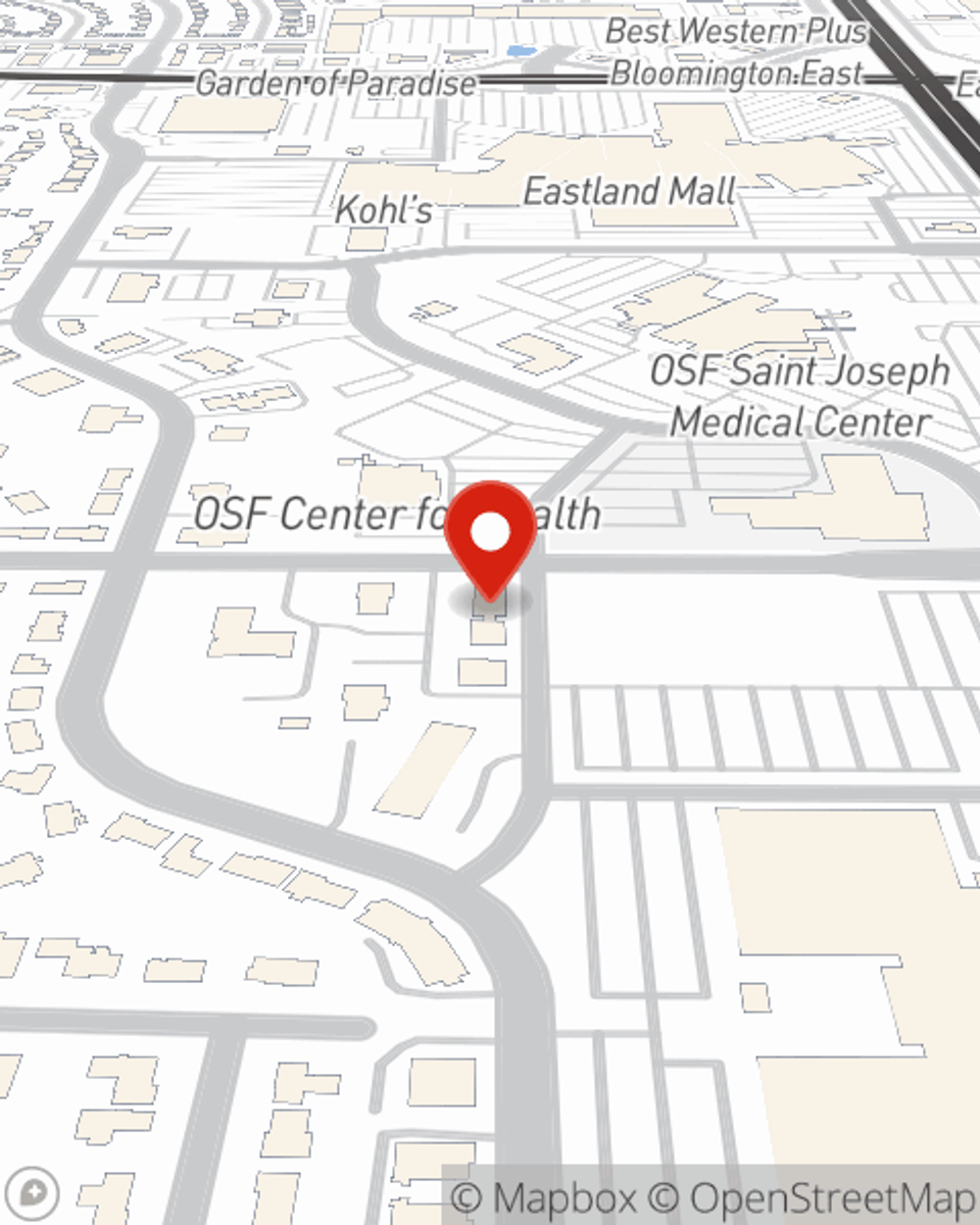

The right coverages can help keep your business safe. Consider visiting State Farm agent Mike Wieland's office today to learn about your options and get started!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Mike Wieland

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.